Updated: January 30, 2012

READ ABOUT NEWS AND EVENTS THAT IMPACT CFL

MEMBERS.

LOCAL ASSOCIATIONS ASSESS AND PLAN FOR CFPB IMPACT. January 30, 2012

The three short term lending associations in

Alabama (Council For Fair Lending, Modern Financial Services & Title Pawn

Council of Alabama) have worked overtime since last Thursday, January 19th to

first assess the impact and then discuss our options to address the CFPB

challenges which are about to be thrust upon our industry.

Here is our belief of the impact at the moment.

First, you should read the update below with the CFPB field examination document

in your hand (click here).

We must advise that this update is preliminary and sketchy at the moment and it

will most likely change many times as more is learned of the agencies plan:

1) Sometime in a window from three months to seven

or so months (May to August) we may well see federal compliance enforcement per

the CFPB field examination document with federal examiners in stores and 2) The payday serial loans issue

(what many call extensions and re-writes), also referenced in the examination

document and discussed by Cordray last Thursday, will most likely not come into

play until the regulatory process begins and that may be 8 to 12 months out. As

mentioned previously, that is an opinion and is a fluid situation subject to

rapid change.

With regard to enforcement, here is a brief list from the

CFPB field manual:

Truth in Lending Act/Regulation Z

Equal Credit Opportunity Act/Regulation B

Electronic Fund Transfer Act/Regulation E

Fair Debt Collection Practices Act

Fair Credit Reporting Act

Gramm-Leach-Bliley Act

Third-Party Relationships

Vendor Management

Other Risks to Consumers

Sustained Use

The first six items are existing federal laws that are

complex and extensive in their scope and touch virtually every aspect of our business.

Penalties for non compliance can be massive and devastating.

Here are a few points we have discussed regarding

planning:

1) Small Business Speed Bump. In our conversations

we discussed the small business "speed bump" component of Dodd Frank. We have

had discussions with a DC lobbyist who actually worked for the SBA at one point

and administered the SBA Office of Advocacy. That agency and department are

uniquely positioned to stand up for small business and they have been effective

in the past. Rather than attempt to explain, please read

this

description.

The speed bump is by no means a silver bullet and the best we might hope for would be some

modest improvement in regulations and perhaps a lengthy delay (from a few months

to a year or so). That, however, might be enough time for a better political outcome.

2) New Products/Legislation. We have discussed this topic but have made

no decisions. We know that some of our existing products (statutes) may be a

lightning rod for the CFPB. We are in the early stage of discussing

alternatives and changes to all of them.

3) Compliance. We have many ideas regarding compliance. One idea that may

work is a central association compliance resource that is dedicated to our

associations to provide compliance support to members of all associations.

We have had preliminary discussions with a national law firm that specializes in

financial compliance issues,

Ballard Sphar, and believe this concept may have

some merit. It is too early to tell for sure, but certainly we will continue to

explore this and other options.

That is our update for now. As you can see from this

report, our industry will face significant changes as a result of this new

agency. We are working hard to provide as many answers as we can.

This will be a fast moving train after it pulls out of the station -- which is

soon.

REPORT FROM THE CFPB HEARING TODAY. January 19, 2012 - 5:45 PM.

This is an update to today's CFPB hearing.

We will be fairly brief in this update and get more information to you later.

Here are the primary points we want to pass along:

1) The CFSA coordinated the event with some support from

our local trade groups. They did an incredible job of organizing our

response.

2) The event was formal, structured and the CFPB adhered

to the schedule. It started at 12 PM and was over by 2:30 PM. The primary

focus of the hearing was centered on the consumer so you can imagine how our

industry was portrayed. Our industry had several customers there to

testify and those customers did an outstanding job.

3) The industry was generally pleased with our response

and our showing in the hearing.

4) Expect heavy press coverage with the usual slant

against our industry. The CFSA media response team, with support from our

local Borrow Smart representative, was great. But that just moved the

needle -- it did not peg the needle.

5) From the prepared statements by the CFPB we believe the

CFPB will become active and visible in their efforts perhaps within the next 90

days. They did not identify time frames but they clearly spoke as though

it was sooner rather than later.

In closing, the CFSA deserves a very big thank you from

the entire industry for their work. The results were outstanding.

Actually, they were extraordinary if you consider they only had five days to

pull this all together.

That's about it. We will get more information to you over

the next few days.

READ A PRIVATE UPDATE DIRECTLY FROM CFSA REGARDING THE CFPB

MEETING. January, 18, 2011.

The CFSA has published a couple of documents

you want to be sure you read. This is the very latest

information about the event and about attending. Be sure to

read it carefully and also be sure to scroll down and read both

pages!

CLICK HERE.

Below is a Google map to the

Birmingham Sheraton Hotel if you need help locating the meeting.

View Larger Map

CFPB TO HOLD HEARINGS IN BIRMINGHAM. January, 16, 2011.

The new CFPB (Consumer Financial Protection

Bureau), which only recently named their new director with a

controversial appointment, is now set to begin their regulating

effort. The have set a field hearing for this coming Thursday,

January 19 in Birmingham.

Click here to see the notice. It is noteworthy they selected

Birmingham as the venue for this first ever field hearing. It is

noteworthy on two accounts. First, Birmingham is noted as a

birthplace for the civil rights movement (the hearing is being held at

the Civil

Rights Museum) and second, we recently went through an extended

battle over a moratorium against short term lending (click

here) in Birmingham.

The big question is -- what is the impact?

The answer is -- no one knows. The announcement was made last

Thursday in the press. Borrow Smart is working closely with the

CFSA to coordinate attendance and media at the hearing. The CFSA

has developed a relationship with the CFPB but the CFSA has not

published a public statement yet.

It will be after the hearings before we have more

information. At a minimum, we believe this may mark the beginnings

of the CFPB's regulatory effort. But beyond that we do not know.

We will report back after the hearing with more information.

BORROW SMART ACTIVITY UPDATE.

July 16, 2011. Over the last

six to twelve months the threats against our industry here in

Alabama have been unbelievably quiet. We believe there are

significant factors for this strange course of events (strange, at

least, for our industry). They are: 1) The incredible success

of our proactive effort here at Borrow Smart, 2) the focus of our

industry lobbyist and the support he receives from our Borrow Smart

effort as he goes about his job and 3) more recently the election of

a business friendly legislature in our state which, by the way, will

need to hear our Borrow Smart message to be sure they remain

"business friendly." Having said that, we are not sitting on

our laurels! Over the last six to twelve months we have:

-

Responded promptly and forcefully in

support of our industry in articles that appeared or were

planned in the local news in Anniston, Decatur, Dothan and

Tuscaloosa. Through Borrow Smart we have our responses

published quickly and succinctly. It is our response that sets

the tone that carries our message from the local community to the

statehouse and beyond.

-

Continued our well received financial

education series with seminars in Mobile during financial

education month (April). These series have drawn interest from

a number of groups who in the past might be considered adversaries

and who have expressed an interest in a joint participation effort

with us in this program. Our program is recognized as a

professional, well developed program and is a quiet successful

endeavor that we plan to continue.

-

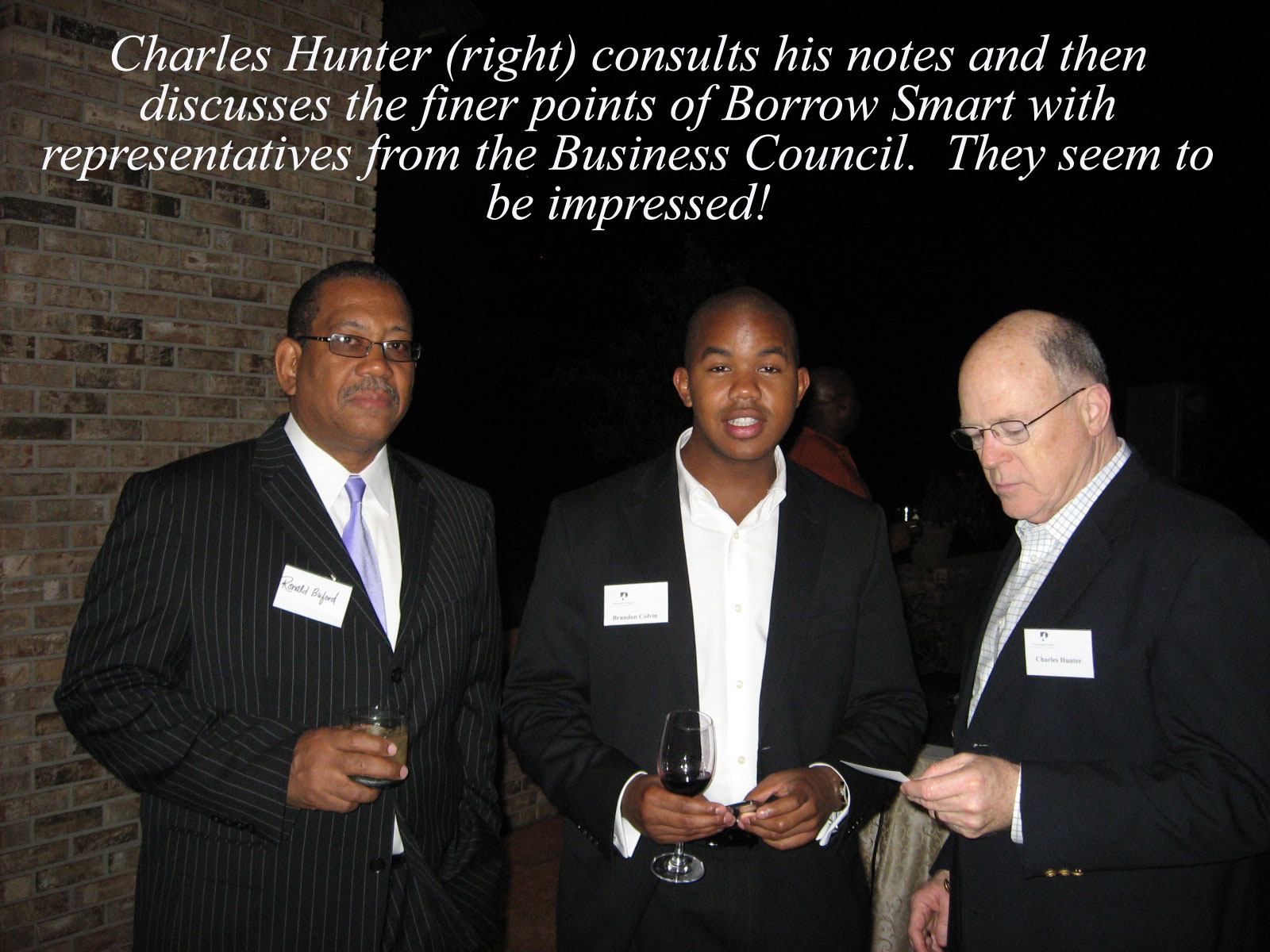

Co-Sponsorship of the annual Black Caucus

event in Point Clear, AL. Last October was our fourth annual

sponsorship. As always, this event focuses on getting our

message out to a group that often times may be considered a foe.

This is a great event for us and we have made so many friends over

the last few years participating in this important event.

These are friends that we hope to count on to hear our story and

understand the needed services that we provide to their constituents

in the communities we serve.

-

Co-Sponsorship of the annual Black

Achievers award gala (click

here). This event recognizes members of the

African-American community who in their lifetimes have made

significant contributions to the community. The primary

sponsor of the event is Regions Bank and we are one of a handful of

co-sponsors. The event is attended by leaders across our state

and this year there were almost 500 in attendance. Our

co-sponsorship is well recognized throughout the event, so we get

great recognition for our effort. This is another great event

with an opportunity for our positive message to be heard directly by

those who really count.

Also of interest is that our neighbors and friends

next door in Mississippi were the focus of a national, full-fledged

frontal assault over the last year to eliminate the industry in that

state. This assault was no different than the assaults seen

previously in places like Arizona, Ohio, Montana, Oregon and so many

other states many which have been legislated or voted out of business.

There were two major differences in Mississippi -- first, they had a

Borrow Smart that played a major role in their battle and second, they

are still in business with very minor changes in their payday laws

thanks in great part to their Borrow Smart effort.

As for back here at home you can see how we fared

in the Alabama Legislature this year by

clicking here to read

the lobbyist report over at the TPCA web site.

Of course we are not fully "out of the woods."

We know the assault in Mississippi had a significant focus at the

community level where our adversaries work to have our industry closed

down and zoned out of business. This is a common practice because

it plays to their strengths (local community activist) and frankly it

works in many cases. We have seen it here in communities on the

gulf coast, Gardendale, Midfield and even some action in Birmingham.

We will not take action in all cases but stand ready to do so if the

circumstances require action.

So, in closing, although we do not see an imminent

threat here in our state right at the moment we know that we must be

prepared. You don't cancel your insurance because your house

didn't burn down and at Borrow Smart we plan to continue doing what it

takes to protect our customers' and our members' interest. We will

continue to do the "Smart Thing" for all of us.

BORROW SMART CO-SPONSORS ALABAMA BLACK CAUCUS MEETING.

October 19, 2009. For the third

year in a row we have co-sponsored the Alabama Black Caucus annual event

reception.

Click here

and read the full story about this exciting event that has paid

incredible dividends for our industry and our members.

PAYDAY INDUSTRY ASSAULT IN ALABAMA - AN UPDATE.

October 5, 2009. It is quite clear

the assault against our industry (described below)

has now moved from the meeting of September 24th to the press, as we

fully expected. If you have followed Borrow Smart for any length

of time you know from our many comments that this assault against us

is directly from our adversaries play book. That is, the assault

begins by motivating local adversaries (Arise on September 24th) and

then going on the attack against us in the press (as seen here)

and finally moving in for the kill in the statehouse. Of course,

this can evolve over months and years. If Arise and their national

cohorts are committed to this assault for the long term, you can expect

much, much more. The big question is this: Is this whole

exercise a trial balloon to see

what support our adversaries can garner and to test the industry resolve, and

more important, the ability of our industry to fight this self-serving

attack? It will not take long to determine the answer this

critical question.

Here is a summary of our response since learning

of the Arise conference less than ten days ago:

-

Met with key legislators who were on the panel

ahead of the Arise meeting on September 24th (click

here).

-

Attended the Arise conference on

September 24th.

-

Launched Borrow Smart educational training in

the Montgomery market. The first event was on THE VERY DAY

of the Arise Summit and generated positive media coverage as we

expected (here and

here).

-

Responded rapidly and succinctly to the many

press articles from our adversaries where we felt it was appropriate

to respond (here).

-

Co-sponsored the annual Alabama Black Caucus

event where we had an opportunity to get "up close and personal"

with key legislators who may be affected and motivated by this

event.

All of the above has occurred in less than fourteen

days from the day we first learned of this event! We are confident that we are

prepared to deal with this -- at last for the present. We may need to do more if this moves to another level, but we have the pieces in place today to react, as you can clearly see. And, keep this critically important point in mind, our

adversaries may determine from our swift and strong response that this

may not be a cake walk as it has been in most other states. They

may just decide to pick another fight on another issue and drop this

one. Either way, we are prepared.

As we have always stated,

the days of our industry only having a lobbyist program are long gone.

Look at this event -- none of it involved a single lobbyist. This is a public

battle and it must be fought on the public front, which is exactly what

we have done. If we wait until our adversaries build up a

groundswell against us and then move to the statehouse it could very

well be

too late! The time to deal with this is right now -- not after the

bills are introduced. Look around at the other states, once the

issue arrives in the legislature it becomes significantly more difficult

to deal with. And, if it gets that far and does not succeed at

first rest

assured they will continue to come back year after year. So, we

must make every effort to deal with this now.

Count your lucky stars that the industry leaders

in Alabama stepped up well in advance (2007) to make

these preparations, which you can now see are so obviously needed.

Be glad you operate here and not some other non-Borrow Smart state.

There is absolutely no way we could have launched any meaningful response

in such a short time if we had not established Borrow

Smart. It would just be impossible to respond in a matter of days

as we have done. Absolutely

impossible! Further, we believe this effort may send a message to the

other side to move on to another state without a Borrow Smart

(deterrence!).

Our adversaries have clearly had much better luck outside of Alabama. We hope they heard

us! We shall see.

ALABAMA ARISE CREDIT SUMMIT UPDATE.

September 26, 2009. The Alabama Arise Short Term Credit conference was held on Thursday,

September 24, 2009. We attended most of the conference but

were "discovered" at about 3 PM and asked to leave, which we did.

The bottom line is that this was a well organized

and incredible gathering of local and national activist who have one

goal -- the elimination of payday lending. You can

click here for a full

report.

WHAT BORROW SMART HAS DONE

We have taken action. First, we visited two of the three legislators on the

panel in advance of the meeting. We were received with mixed results.

Representative Busky invited one of his legislative friends,

Representative Kennedy in his adjoining district in Mobile, to attend

the meeting with him. They were both receptive to our discussions.

Senator Ross was not overly receptive to our point of view, but did

listen to our position. He was also the most vocal against our industry

at the Arise meeting.

We have not taken this situation lightly at Borrow

Smart. In fact, it is potentially the most significant challenge

we have ever seen against our industry here in Alabama. We have undertaken several

public initiatives as a result. The first was a TV appearance on

the largest station in Montgomery on the day of the event (click on the

image to the right). The second is that we have scheduled a financial education

seminar on Tuesday, September 29th at one of the larger high schools in

Montgomery. We fully expect this will generate a good bit of media exposure

and support for what we are doing as we have seen from previous events

(as seen

here). In fact, that is the focus of

the TV story above. Thirdly, we will attend and co-host the Alabama

Black Caucus annual event later in the week (Thursday, October 1st).

We will have an opportunity to meet in a social setting many of those

who do not fully understand what we do and give them the "other side" of

the story and tell them what we are doing for consumers in their

districts. This is the third year we have hosted the meeting and

it has been an incredible event for us. This year's meeting has

sure taken on a new meaning, though. Scroll down to the next story

to read more about the Black Caucus meeting.

against our industry here in Alabama. We have undertaken several

public initiatives as a result. The first was a TV appearance on

the largest station in Montgomery on the day of the event (click on the

image to the right). The second is that we have scheduled a financial education

seminar on Tuesday, September 29th at one of the larger high schools in

Montgomery. We fully expect this will generate a good bit of media exposure

and support for what we are doing as we have seen from previous events

(as seen

here). In fact, that is the focus of

the TV story above. Thirdly, we will attend and co-host the Alabama

Black Caucus annual event later in the week (Thursday, October 1st).

We will have an opportunity to meet in a social setting many of those

who do not fully understand what we do and give them the "other side" of

the story and tell them what we are doing for consumers in their

districts. This is the third year we have hosted the meeting and

it has been an incredible event for us. This year's meeting has

sure taken on a new meaning, though. Scroll down to the next story

to read more about the Black Caucus meeting.

CONCLUSION

We have met internally to discuss the impact this event might

have on our industry. We believe it can be devastating if Arise

and their cohorts are able to gain traction on their action plan.

We are not sure they can do this in an election year with many other

critical issues facing our state. To be honest, we just are not

sure it will gain momentum -- at the moment. It can all

change in an instant, though. If Arise and their partners, who are

many and have tremendous resources, are able to generate grass-roots

support in the local communities they will make significant

headway against us. We clearly believe it is possible. We

are not, however, sure it will happen. The best way to describe

the situation is we are sitting on a truck load of dynamite at the

moment. If someone manages to find the fuse we are in big trouble!

Our strategy then, at the moment, is to continue to do all

the things we do at Borrow Smart and to take this time to build our

action plan in the event the Arise plan begins to take on a life.

We clearly can not wait until Arise and their cohorts have begun a

groundswell against us. We must be ready to go or be ready to

close down. It is really our choice.

Finally, two things are incredibly important at

the moment. We need everyone in the industry to support us in this

effort, not just a few. That is we need more members. So,

please do all that you can do to encourage owners you know to join us.

It is real easy. Just click

here. Second, we need to do more than just be prepared to work

in the media. We need to be prepared to fight it out in the

communities and to work smarter than our adversaries with their well

proven advocacy action plans.

We will report back later.

BORROW SMART WILL CO-HOST THE ANNUAL BLACK CAUCUS EVENT BUT WITH A

WHOLE NEW AND CRITICAL MEANING THIS YEAR.

September 8, 2009. Borrow Smart will again co-host the annual Black Caucus event to be held

in Point Clear, AL on October 1st. This event has been a great

opportunity for us to make important friends and spread the Borrow

Smart word to a targeted group of Alabama legislators. This group

is important because in the past they have not always heard the

"real customer side" of our story and they have not always understood or much

cared for our business. Remember, at Borrow Smart we represent the

customer side of our industry with important messages not previously

heard from the press and others. This is an important message for

our friends to hear and that is what we do. We have made many good

friends at this event in the past and we expect this year will be no

different.

Click here to see reports from prior year's events.

word to a targeted group of Alabama legislators. This group

is important because in the past they have not always heard the

"real customer side" of our story and they have not always understood or much

cared for our business. Remember, at Borrow Smart we represent the

customer side of our industry with important messages not previously

heard from the press and others. This is an important message for

our friends to hear and that is what we do. We have made many good

friends at this event in the past and we expect this year will be no

different.

Click here to see reports from prior year's events.

This event takes on a significant new meaning this

year, though. Read the post directly below to see the threat we

now face from what could be a relentless, national assault against our

industry right here at home in Alabama. Note that the legislative

participants on the panel are all minorities who have not always been

our friends. Some of these same people will attend the the Point

Clear meeting. More than ever before, we need to communicate our

customer's voice and not some self serving industry "we do good" message

that we know does not work. And our adversaries need to hear it

from us and not from a powerful national group like the CRL from

Washington DC with incredibly deep pockets and almost unlimited

resources!

though. Read the post directly below to see the threat we

now face from what could be a relentless, national assault against our

industry right here at home in Alabama. Note that the legislative

participants on the panel are all minorities who have not always been

our friends. Some of these same people will attend the the Point

Clear meeting. More than ever before, we need to communicate our

customer's voice and not some self serving industry "we do good" message

that we know does not work. And our adversaries need to hear it

from us and not from a powerful national group like the CRL from

Washington DC with incredibly deep pockets and almost unlimited

resources!

We want to again alert you that this event in

Montgomery has the potential to trigger a massive assault against us.

We know this well from watching it unfold in almost 18 other states over

the last two years. This is how it all begins. And, we

probably do not need to tell you how it ends. Just look at Ohio,

Virginia, Georgia, Florida and a whole host of others. You will see!

NEW INITIATIVE AGAINST THE INDUSTRY IN ALABAMA.

September 2, 2009. We have just learned of a conference that will take place in Montgomery

on September 24th. You can click

here and

here to

see the flyers that describe the conference. At the moment we are

treating this as a major event! Look at the roster of national

groups that are attending this conference and we believe you will

understand why. We are planning our course of action and will

report back soon.

of a conference that will take place in Montgomery

on September 24th. You can click

here and

here to

see the flyers that describe the conference. At the moment we are

treating this as a major event! Look at the roster of national

groups that are attending this conference and we believe you will

understand why. We are planning our course of action and will

report back soon.

BORROW SMART MARKS FIRST YEAR IN BUSINESS!

April 26, 2009. Depending on how you count, Borrow Smart has been in business

for almost a full year now. What started as a bold idea in late

2006 by a few industry leaders in Alabama brings us to where we are today.

Read on for a full report.

We

began our organizational effort in January 2007 and by May of 2007 we

were incorporated, funded, had dues paying members who were fully committed and

had a

governing management team. From that point on, we were engaged.

We launched our public initiative in October of last year.

You can read

the launch report here. Suffice it to say the launch was an

incredible success.

Since then we have exceeded our expectations beyond anything we ever

anticipated. Here are the highlights of our activities and accomplishments so far:

-

Launched a well received, statewide media campaign that

announced Borrow Smart to the citizens of Alabama which included our

customers, legislators, regulators and the general press.

-

Held highly successful press conferences announcing

Borrow Smart in Montgomery and Birmingham.

-

Received many positive press reports on our imitative

that represented a 180 degree turn from the old press stories of the

past.

-

Launched an interactive web site with

professionally produced customer video testimonials and an

interactive store locator.

-

Received reports from key legislators on recognition of

and accolades for Borrow Smart Alabama.

-

Held incredibly positive editorial board meetings

with the states two largest print publications -- The Birmingham

News and The Montgomery Advertiser.

-

Launched advertising in the state-wide Community ReInvestor magazine to promote wise use of our services

to one of our target consumer groups.

-

Mounted challenges to many negative and inaccurate

press reports about our industry with corrections and/or positive

responses from most.

-

Worked with local TV and print reporters on

industry stories that resulted in an entirely different tone about

our industry. A tone we have ever seen in the past.

AREN'T OTHERS DOING THIS?

We don't think so. Certainly, no one that we know of has launched

a total campaign that includes:

-

A local, grass-roots communications effort

closely coordinated with a local lobbying effort.

-

A consumer oriented effort as opposed to an

obvious industry "we say this about ourselves" approach. The consumer

oriented name says it all --

Borrow Smart.

-

Production of television quality customer video testimonials

that tell unique, real and very touching customer stories on the use

of our services.

Click here to view testimonials.

-

A state-wide, paid multi-media communications

program.

-

A knowledgeable, "media friendly" industry

spokesperson (Charles Hunter) for a common, consistent industry

consumer oriented message.

-

Professionally produced in-store materials

identifying our members as Borrow Smart stores.

Click here to see store kits (be sure to scroll down to see all

components of kit after you connect).

-

Representation of the "short term lending

industry" which includes both payday and title lending --

not one or the other, but both.

Borrow Smart had many critical elements

that had to come together in perfect

order to be successful

(read about them here). Had any one of them been missing or

not executed properly the results could have potentially backfired. But,

thanks to an incredible team of folks that included Big Communications,

Michael Sullivan and others, it all come off with remarkable results.

Others outside of Alabama have done parts of our Borrow Smart program

and CFSA has a highly successful, broad based national program for

payday lending only. But no one has put it all together as in

Borrow Smart with a local, grass-roots, consumer focus. That is

local, as in "where the decisions are made." The Borrow Smart effort has made incredible

inroads for our industry in our state. Inroads and results that

have never been made before. Not by CFSA or anyone else.

If

you doubt what we have accomplished look at the many other states that

depended only on a local lobbying effort. Some went a step further

and simply hired a PR firm to send out press releases to tell the industry story or

some depended on a national campaign to save their hides. Do

a little research and see where most all of those states are today or

just click here.

They are surely not where we are! We believe a

totally integrated campaign makes the difference.

As we have said on many occasions, a local grass

root effort is critical and we must represent all of the short term loan

industry -- which includes both payday and title lending. We

did that. No one else did it and we firmly believe the results

speak for themselves.

WHAT WERE THE RESULTS?

Quite simply, we believe the results speak volumes

about what we have accomplished. Our results can be measured by our industry

perception along with the press stories and articles that shape our perception.

These were noticeably changed by Borrow Smart. There is still much

to do, but we've made a significant first step. Another key

measurement is the lack of adverse action against our industry.

Adverse action that results from the continuous one-sided press attacks

and the resulting perceptions that follow directly as we have seen so many times in the past.

Go to our affiliate association

here and read all about what we really accomplished this year. The proof is in the pudding, and

the pudding was served in a full bowl -- at least for this year.

Soon

we will get to start all over again.

LEGISLATIVE REPORT FROM LAST WEEK.

April 21, 2008.

Click here and jump over to the TPCA

web site for an update to last weeks legislative activity.

SURVEY RESULTS FROM MEMBERS.

April 21, 2008. Last week we sent out a survey with several questions about our next

meeting and about how we keep our members informed.

Go here

to see the results. Thanks to all who participated. We will

get back soon with an action plan.

BORROW SMART TO ATTEND BARRON PRESS MEETING ON PAYDAY LEGISLATION.

April 7, 2008.

Click here to go over to News at our

affiliate TPCA site for the latest.

MORE ON THE BORROW SMART ALABAMA LAUNCH! November 12, 2007.

The good things continue to roll in following

our Borrow Smart launch. Here are a few items that may be of interest:

-

Borrow Smart is a hit at the Alabama Black Caucus

meeting

-

Surprise report from an Alabama State Senator

-

Borrow Smart store kits

-

A great meeting with Birmingham News editorial

board

-

New Borrow Smart initiatives

-

New Borrow Smart members

You can read more about the recognition our

members are receiving as Borrow Smart members from some very important

and influential groups and individuals. They know about our

members because we tell them and because they are

visiting our web site in droves.

Click

here to read this special, members only full report.

BORROW SMART ALABAMA HAS SUCCESSFUL LAUNCH! October 22, 2007.

Our press conferences and our launch are now

done! They were a whopping success. See

our full report

here. Below is a list of some of the media coverage following the

press announcement of our

Borrow Smart launch:

TV Ad

Radio Ads

Montgomery Advertiser

Birmingham News

Our Reply To Birmingham News

Google Search On The Web

TESTIMONIALS ARE ON THE WEB! October 19, 2007.

Our first CFL project is now an overwhelming

success thanks to all of you and to our customers.

GO HERE

TO SEE.

TESTIMONIAL TAPING IS COMPLETE. THE HEAVY LIFTING IS DONE! August 28, 2007.

We have finished the taping and it came off very

well -- thanks to Robin at Big Communications! Check here soon for

when the finished product will be available. It will, at a

minimum, be several weeks.

NAMES & SCHEDULES ALL WRAPPED UP FOR TAPING THIS WEEKEND. August 21, 2007.

We have finished the testimonial selection and

schedule for taping.

Go here for a

list of those who will visit Birmingham this weekend for the taping

session. Big Communication has put together packets for each

customer and they have been mailed to the store from which each customer

was referred. The customers have been instructed to stop by the

stores to pick up their travel package before coming to Birmingham.

Click here

to see the welcome package and what is included for the customer.

We've tried to think of everything, but if you see we've missed

something, please notify Robin immediately and we will get it fixed.

Robin has been in constant communication with the

customers so they should have all the information they need. If,

however you or your customer need more information please contact Robin

at robin@bigcom.com or

205-322-5646 ext. 103.

As you can see from the welcome package, this

should be a fun weekend for everyone involved -- not to mention being

very productive for our CFL effort! We are anxious to get reports

back from you all on what your customers thought.

Click here and drop us an email and let us know.

There are a couple of additional items to mention.

First, we do plan to notify those who were not selected and thank them

for their effort. Second, we are several weeks away before we see

the finished testimonials. We have a few others who we may record

in the next week or so and afterwards we will need time to edit and make

them ready for distribution.

TESTIMONIAL PROGRESS & UPDATE. August 13, 2007.

We are almost there. Robin has set a date

for August the 24th and 25th as taping dates in Birmingham. About

two-thirds of the target prospects are committed to the session.

We will publish a list as soon as we have the full list of prospects

committed. We expect that to be in the next day or so.

TESTIMONIAL PROGRESS & UPDATE. August 7, 2007.

We are getting very close to our short list of

testimonial prospects for taping. But, we are not quite ready to

publish them. We should be ready within a few more days.

Robin has been in constant touch with all of the prospects and is

working toward a date for the taping. The dates are in August and

are Friday and Saturday the 17th and 18th or the 24th and 25th.

The plan is to tape on Friday and Saturday to accommodate our customer's

schedule. We will get back to you in a few days.

We know these are going to be incredible!

TESTIMONIAL PROGRESS & UPDATE. August 1, 2007.

Thanks to everyone who submitted testimonial

stories! We have over 60 customer testimonials that were submitted

by our members. There are some really tremendous stories. We

have always said our customer's value the service we provide. That

clearly comes across in what our customers have told us during this

project. We know we will have some great videos from this effort!

At the moment, we are in the process of contacting

the prospects and making a short list of those customers who are

interested in telling their story on video. We expect this process

will take at least another week to 10 days. We will get you

information as soon as we complete this next phase. In the

meantime, some of you may hear from Robin Oliver with Big Communications

in connection with the names and stories you submitted.

We will get back to everyone in about ten days.